Tariff Impact Analysis

For a comprehensive guide to conducting these analyses, please see Distributed Solar Utility Tariff and Revenue Impact Analysis: A Guidebook for International Practitioners.

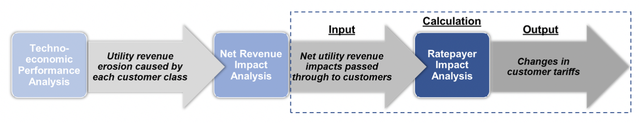

Analysis of Linkages and Applications

Tariff impact analyses are deeply linked to net revenue impact analyses, as they use their outputs—in the form of annualized utility revenue impacts—as an input for calculating tariff impacts. Thus, similar to net revenue impact analyses, tariff impact analyses are calculated for specific DPV deployment scenarios with distinct assumptions, including an amount, location, customer mix, and time frame of DPV deployment.

Utilities, regulators, and energy ministries can use tariff impact analyses to bound concerns about expected DPV financial impacts to ratepayers under current policy and market conditions or, in some circumstances, to characterize tariff impacts that have already occurred. Tariff impact analyses can also be used to quantify how a particular change in policy (e.g., a shift from net energy metering to net billing) or regulation (e.g., the addition of an interim rate adjustment mechanism to normal ratemaking processes) may impact ratepayers in the future.

Background: Tariff Impact Mechanisms and Time Frames

Several basic ratemaking terms are helpful to understand as background knowledge for tariff impact analysis:

-

Revenue Requirement – The total expected amount of revenue required by a utility over a rate period (see below) to cover approved expenditures and earn a regulated rate of return. Electricity tariffs are designed to collect the revenue requirement over the rate period, using sales data for either historic or future “test years” to inform estimates of sales for each customer class. DPV can impact the level of the revenue requirement itself (e.g., through reducing required fuel cost expenditures) and/or the ability of the utility to meet its revenue collection target (e.g., due to reduced sales).

-

Rate Period – The period of time over which a specific set of tariffs is implemented for a utility to collect the revenue requirement. Rate periods are typically at least 1 year long.

-

Rate Case – A periodic regulatory proceeding where the revenue requirement is set, deviations in revenue collection from past rate cases are reset (and potentially reconciled), and retail electricity tariffs (and, if applicable, wholesale electricity tariffs) are designed with the intention of ensuring that the utility collects the revenue requirement over the following rate period.

-

Interim Tariff Adjustment Mechanism – A mechanism that permits changes in retail or wholesale electricity tariffs between rate cases (i.e., within the rate period). The need for adjustments may be driven by changes in the cost of fuel or purchased power expenses, and potentially DPV deployment as well. The mechanism may be invoked on a regular basis (e.g., every 6 months), or be triggered by specific events (e.g., following an extreme weather event).

Depending on the details of the regulatory framework of the jurisdiction being analyzed, utility net revenue impacts either (1) accrue for the entirety of the rate period (e.g., 2 years) and are reconciled at the subsequent rate case, or (2) accrue for a shorter time period (e.g., every 3 months) and reconciled via an interim tariff adjustment mechanism. It is worth noting, however, that not all net revenue impacts are necessarily reconciled; again, it depends on the specifics of the regulatory framework in the jurisdiction being analyzed.

Typical DPV Net Revenue Impact Drivers

DPV deployment can cause short-term changes in utility operational expenses and/or revenue collection. While the exact utility costs and benefits that might be passed through to ratepayers in these analyses depend on the specific utility entity being examined, they typically include:

Costs

-

Reduced utility wholesale and/or retail electricity sales

-

Additional required utility expenditures to purchase DPV grid injections

Benefits

-

Reductions in bulk generation costs and/or wholesale electricity purchase costs

-

Avoided network losses

For more details on potential utility revenue impact drivers, see Net Revenue Impact Analyses.

Understanding Ratepayer Pass-through Rules

Foundational to any tariff impact analysis is an understanding of how exactly changes in utility operational expenses and/or revenue collection due to DPV are passed through to ratepayers. In practice, this requires an accurate understanding of the following questions:

- To what extent are various DPV costs and benefits passed through to ratepayers versus absorbed by the utility?

The rules about which DPV costs and benefits can be passed through to ratepayers depend on the details of the regulatory framework in each jurisdiction. For instance, a distribution utility may be able to recover costs associated with purchasing DPV grid injections, whereas it may not be able to recover its fixed costs in full as a result of lower sales due to self-consumption of DPV. In general, for each benefit and cost quantified in the underlying net revenue impact analysis, analysts must determine to what extent each is passed through to ratepayers.

- What regulatory mechanisms are used to pass through each cost and benefit? What is the time frame of the mechanism?

It is also possible that the power sector regulatory framework specifies which mechanism specific DPV costs or benefits must be passed through under. For example, in Thailand, additional utility expenditures to purchase DPV grid injections can only be reconciled via an interim tariff adjustment mechanism, whereas lost revenue from sales must be reconciled during the subsequent rate case. Depending on the analysis period of study, analysts may need to track the mechanism and associated timing of tariff impacts. Generally speaking, annual calculations should meet the needs of most stakeholders.

Example Tariff Impact Equation

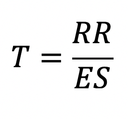

In their most simplified form, electricity tariffs for a given customer class are set by dividing the portion of a utility revenue requirement allocated to the customer class by the expected or past electricity sales for that class in a given rate period. An example equation for an average volumetric electricity tariff would thus be:

where,

- T[$/kWh] = average tariff for rate period under consideration

- RR = utility revenue requirement for rate period under consideration

- ES = expected total sales during rate period

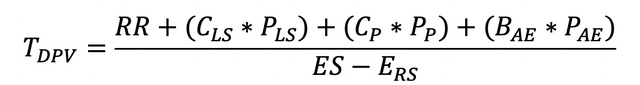

An example equation for an average volumetric energy tariff, which includes consideration of the changes to utility revenue and operational expenditures due to DPV mentioned above under Typical Net Revenue Impact Drivers, would be:

where,

- TDPV[$/kWh] = average tariff for rate period under consideration

- RR[$] = utility revenue requirement for rate period under consideration

- ES[kWh] = expected total sales during rate period

- ERS[kWh] = average tariff for rate period under consideration

- PLS[kWh] = utility revenue requirement for rate period under consideration

- CLS[$] = expected total sales during rate period

- PLS[%] = average tariff for rate period under consideration

- CP[$] = utility revenue requirement for rate period under consideration

- PP[%] = expected total sales during rate period

- BAE[$] = utility revenue requirement for rate period under consideration

- PAE[%] = expected total sales during rate period

The above example equation can be customized for each jurisdiction and the relevant costs and benefits that will be tracked. If sufficient data is available on how current tariff structures are typically formulated for each customer class–including information on how revenue requirements and expected sales are allocated across each customer class—it may be possible to calculate rate class-specific tariff impacts.

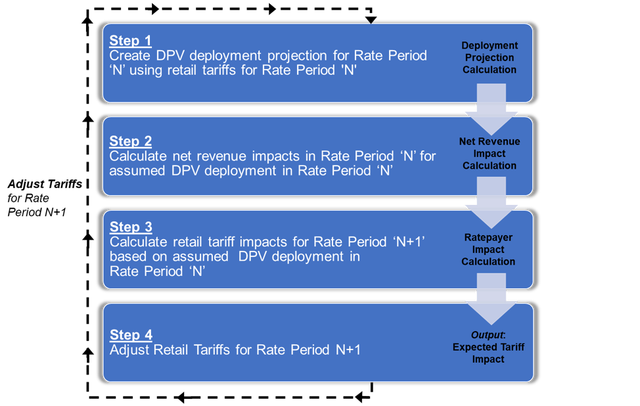

Linking Tariff Impact Analyses with DPV Deployment Projections

DPV deployment is strongly influenced by the economics of DPV for prospective customers, and among the key drivers influencing DPV economics is retail electricity tariffs. Thus, there is a natural linkage between Tariff Impact Analyses and DPV deployment projections. In these hybridized analyses, forecasted DPV deployment for rate period ‘N’ results in retail tariff changes for rate period ‘N+1’. The economics of DPV systems for rate period ‘N+1’ consequently shift due to the changes to tariffs, influencing the DPV deployment projection for rate period ‘N+1’. This iterative analysis process is depicted in the graphic below.

Analysis framework to formulate DPV deployment projections that account for DPV tariff impacts

Example Analysis Questions

Below is a nonexhaustive List of Illustrative analysis questions for Tariff Impact Analyses.

- Assuming 200 MW per year of DPV deployment between 2020 and 2025, what is the cumulative expected average retail tariff impact for distribution utility customers?

- What is the expected annual average tariff impact of 250 MW of DPV deployment by high-use residential customers versus agricultural customers for the vertically integrated utility in the 2021 rate period?

- What is the expected change in annual retail tariff impacts if new DPV customers are shifted from net energy metering with no annual net excess generation credit to a buy-all/sell-all scheme with a $0.06/kWh grid injection sell rate beginning in 2022?

- What was the actual tariff impact in the 2019–2020 rate period resulting from all DPV deployment in a distribution utility service territory between 2017 and 2018?

- What is the expected change in retail industrial tariff levels in the 2019–2020 rate period if 100% of utility net revenue impacts driven by deployment across all customer classes between 2017 and 2018 are recovered only through industrial customer tariffs?

- How will the implementation of a revenue decoupling scheme for the 2020–2022 rate period impact average retail electricity tariff levels during the next rate period from 2023 through 2025, assuming 750 MW of cumulative deployment at the beginning of 2020 and an additional 200 MW per year over the 3-year period?

Overview of Key Analysis Inputs, Assumptions, Outputs, and Tools

| Aspect | |

|---|---|

| Stake Holder Perspective | Utility |

| Key Input Data |

Prototypical Customer Data – See table on Individual Project Technical or Techno-Economic Analysis page for review of key input data required to formulate prototypical customers.

Annualized Lost Utility Sales – Total financial value associated with reduction in annual retail and/or wholesale electricity sales due to DPV. The value of a lost utility sale may change dynamically with time if time-of-use tariff structures are present. See table on Net Revenue Impact Analysis page for review of key input data required to formulate these metrics.

Annualized Utility DPV Purchase Obligation – Total additional expenditure for distribution utility or vertically integrated utility to purchase DPV electricity injected into distribution network. The level of utility expenditure required may change dynamically with time based on whether the DPV sell rate is time-variant. See table on Net Revenue Impact Analysis page for review of key input data required to formulate these metrics.

Annualized Avoided Utility Generation Costs or Wholesale Power Purchases – Total annual avoided utility expenditure for bulk electricity procurement due to DPV. The value of this avoided expenditure may change based on the timing of DPV production, as well as the specific means of generation procurement. See table on Net Revenue Impact Analysis page for review of key input data required to formulate these metrics.

Utility Revenue Requirement – For most recent rate period, if possible. Can be estimated if needed (see Discussion and Practical Considerations below). Expected Sales – Expected utility sales for rate period, which corresponds with utility revenue requirement. If possible, real-life expected sales estimate used to calculate tariffs is preferable. |

| Key Input Assumptions |

See Key Input Assumptions on Net Revenue Impact Analysis page to review a range of key assumptions also relevant for Tariff Impact Analyses.

Pass-through Assumptions by DPV Cost and Benefit – Percentage of utility impact that can be passed through to ratepayers for each DPV cost and benefit analyzed.

Annual Growth in Revenue Requirement – For forward-looking analyses, expected growth in utility revenue requirement over time.

Growth in Expected Sales – For forward-looking analyses, expected growth in utility sales over time.

Utility Revenue Requirement Allocation by Customer Class – If class-specific tariff impacts are being calculated, then assumptions about how the revenue requirement is allocated across customer classes (to formulate tariffs during ratemaking proceedings) are required.

|

| Key Outputs |

Total Tariff Impact – Total change in retail and/or wholesale electricity tariffs due to DPV deployment. May be specified on an annual basis, by rate period, or by interim tariff adjustment mechanism period. May be average metric across ratepayers, specified by customer class. Tariff Impact by Driver – Discrete upward or downward tariff impacts driven by specific DPV costs and benefits analyzed. |

| Tools and Models | Tariff Impact Calculations: Design of customized spreadsheet model is recommended for this element of the analysis. No known commercial or open-source models available. |

Discussion and Practical Considerations

Who can conduct this analysis? How costly and time-intensive is it to conduct?

In order to successfully conduct tariff impact analyses, analysts must have a robust understanding of net revenue impact analysis methods and a firm grasp of utility ratemaking processes and tariff calculation principles, as well as a moderate to strong proficiency in designing spreadsheet-based financial analyses. At the time of this writing, there are no existing commercial or open-source “plug-and-play” tariff impact analysis calculators, and thus customized spreadsheet design is currently a requirement. Depending on the availability of relevant data, the level complexity and time granularity of existing retail and wholesale tariffs, the number of DPV deployment scenarios examined, and an analyst’s prior experience with ratemaking processes, tariff impact analyses can take 1–3 months of full-time work to complete, though they can potentially be streamlined significantly if conducted in conjunction with net revenue impact analyses.

What are the key challenges to getting these analyses right?

Perhaps the greatest source of complexity in executing tariff impact analyses is properly ascertaining how various DPV costs and benefits would, in real-life ratemaking processes, be passed through to ratepayers, and thereafter capturing this process within an analysis framework. As well, spreadsheet tools will grow significantly more complex if tariff impacts are calculated for individual customer classes and/or are examined over multiple rate periods. As with many other analysis types, adequate data availability can be a significant challenge. Data surrounding ratemaking processes—in particular revenue requirement levels and customer class allocations—are often considered sensitive in nature in developing country settings and may prove difficult to acquire. Nondisclosure agreements may be required to perform these analyses.

What are some key practical tips to keep in mind?

It is possible that information on the revenue requirement for relevant rate period(s) may not be available. If so, the revenue requirement may need to be estimated. For instance, an annual revenue requirement can potentially be estimated by using recent, publicly available information on utility revenue collection—while revenue collection is by no means the same quantity as a utility revenue requirement, it is potentially sufficient for informing calculations, should nothing else be available. As well, if retail or wholesale sales volumes are known, and information is also available on customer tariffs and the number of customer meters present for each customer class, the analyst can again calculate a rough estimate of the revenue requirement to use as a basis for understanding tariff changes.

Another key dimension to the revenue requirement is information about how it is allocated across customer classes. If this data is available, then it is possible to calculate tariff impacts by customer class. If not, analysts can still conduct an average tariff impact analysis. While it is perhaps not as detailed, this average metric is undoubtedly still useful for providing actionable policy insights.

For forward-looking analyses, formulating assumptions about future revenue requirements will also be an important step. While utility revenue requirements may be available for the current rate period, they will almost certainly not be for the next, or anything beyond that period. Thus, analysts must make assumptions about how this revenue requirement will change with time. Examining historical data can be a useful approach, as can engaging with utility and regulatory stakeholders to discuss expected growth trends. A key consideration here is whether or not the impact of DPV itself would be included in future revenue requirements. In other words, is the revenue requirement assumed to change in the next rate period to account for DPV deployed in the previous rate period? If not, how is it accounted for?

How can results be discussed effectively?

Context matters significantly for presenting results from tariff impact analyses. Utility tariffs fluctuate with great regularity due to changing macroeconomic conditions, weather, fuel costs, and a variety of other factors. These upward and downward tariff fluctuations often occur via interim tariff adjustment mechanisms. Thus, comparing DPV tariff impacts with average interim tariff adjustment mechanism fluctuations can be useful for providing analysis stakeholders with context on how large tariff impacts really are. Are tariff impacts “in the noise” compared to regular fluctuations in retail tariffs? Or are they expected to have a noticeable impact?

It is also useful to present tariff impacts broken down by key drivers (e.g., lost sales, avoided generation costs)—doing so helps to paint a more complete picture to analysis stakeholders and demonstrates the extent to which DPV benefits may offset tariff increases associated with reduced utility sales.

Finally, tariff impact analyses may at times offer analysis insights that are considered sensitive for certain stakeholder groups. It is thus extremely important to be transparent about all analysis methodologies and assumptions when discussing results. The question of which DPV costs and benefits are examined (versus omitted) is common when presenting tariff impact analysis results.

Example Analyses

- Understanding the Impact of Distributed Photovoltaic Adoption on Utility Revenues and Retail Electricity Tariffs in Thailand

- Distributed Photovoltaic Economic and Technical Impact Analysis in the Philippines

- Distributed Photovoltaic Economic Impact Analysis in the Philippines (Webinar)

For further questions, please contact Alexandra Aznar ([email protected])