DPV Market Deployment Estimates

A sequence of Analysis Steps

Importantly, DPV market deployment estimates can comprise several interrelated analysis exercises that help to bound maximum possible deployment levels and then downscale deployment expectations based on market realities.

-

DPV Technical Potential is defined as the maximum possible DPV deployment for a given jurisdiction, typically considering the availability of suitable roof space, but not considering the economics of DPV deployment.

-

DPV Economical Potential is defined as the maximum amount of DPV deployment that could be considered economically viable—with viability often defined using a “net present value” (NPV) metric—in a given year with a static set of market and economic conditions (e.g., DPV system pricing, available DPV compensation mechanisms and incentives, etc.). All potential DPV systems identified in a DPV technical potential exercise are examined and either included or excluded in an economic potential estimate based on their ability to meet specified financial performance criteria.

-

DPV Market Potential is defined as the total amount of DPV capacity that would ultimately be adopted by customers given a long enough period of time under a static set of economic market conditions. Market potential estimates typically use consumer survey data to characterize the willingness of prospective customers to adopt DPV under a range of economic and market conditions (e.g., a 4-year DPV payback period versus a 7-year DPV payback period), and rely on the economic performance analyses performed for understanding DPV economic potential.

-

DPV Market Deployment Estimates are intended to provide actual estimates for expected DPV deployment, and they rely on dynamically updated market potential estimates that change (often on an annual basis) based on historical adoption patterns and future expectations of DPV economic and market conditions (e.g., reductions in DPV prices, changes to policy incentives, etc.).

These analysis steps are discussed in additional detail below.

Technical Potential

DPV technical potential represents the maximum possible DPV deployment—often stated in capacity (megawatts) or annual energy generation (megawatt-hours/year)—for a given jurisdiction. Most DPV technical potential exercises focus on understanding the suitability of existing rooftops to host DPV and do not consider the potential of ground-mounted distributed PV or the construction of new structures (e.g., canopies over parking lots). Importantly, the results of these studies do not exclude systems based on their economic performance, and thus they provide an upper bound on potential deployment rather than any form of prediction of actual deployment.

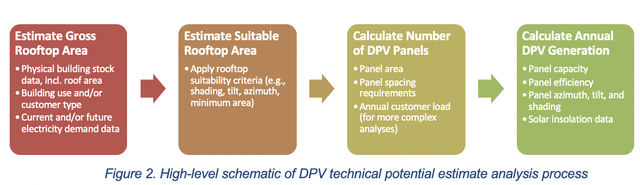

DPV technical potential estimates are formulated through a multistep process. While all analysis approaches are ultimately customized to available data and analysis resources, formulating DPV technical potential estimates generally follows the same high-level steps. To begin, data on the existing building stock in a given jurisdiction is acquired. Roof area is then analyzed for suitability for hosting DPV systems, which may include considerations such as roof tilt, roof orientation, roof area, shading, objects on roof (e.g., chimneys), and, in more detailed analyses, customer electricity demand. At this point, a series of assumptions are made to inform the number of DPV panels that can be deployed on each suitable roof (sometimes including the size of customer load, for more detailed analyses), and then each DPV system is simulated to yield an estimate of technical potential in annual energy generation terms. This high-level process is illustrated and detailed below.

Technical Potential: Estimate Gross Rooftop Area

Existing building stock data often takes the form of satellite and/or light detection and ranging (known as “lidar”) data. Geographic information system (GIS) methods are used to understand gross rooftop area potential and characterize important features of each roof that will be examined in the subsequent rooftop suitability analysis step. These data sets are often quite large and require complex computing methods to manage.

Technical Potential: Estimate Suitable Rooftop Area

Next, gross rooftop area data effectively undergoes a down-selection exercise, where each rooftop is analyzed for its suitability to host a DPV system—rooftops that fail to meet certain DPV hosting suitability criteria are excluded from technical potential estimates. Suitability criteria can include factors such as:

- Roof Orientation—Often referred to as “azimuth,” this is a description of the cardinal direction the roof plane faces. Roof planes facing away from the equator (e.g., northwest, north, or northeast in the northern hemisphere) are typically considered unsuitable for hosting DPV systems.

- Roof Tilt—The tilt of the roof relative to the ground is important for determining its suitability. Whereas 0° tilt describes a flat roof, 30° tilt describes a roof positioned a third of the way between flat and fully vertical. Tilt values greater than a certain cutoff (e.g., 60°) can be excluded from technical potential estimates.

- Shading—Rooftops that receive an excess of shade, and thus a lower-than-average number of sunlight hours per day for a given location, are typically considered unsuitable for hosting DPV systems.

- Roof Area—If a rooftop does not have a single contiguous plane capable of hosting a certain number of DPV panels (e.g., two to four), it may not be considered suitable for hosting DPV systems. Roof area criteria may be less stringent in developing countries where smaller systems may be desirable (or more feasible to invest in) for customers.

- Presence of Demand—With more advanced building stock data sets, it may be possible to understand whether there is electricity demand present for each building and corresponding rooftop being examined. In this case, it may be considered desirable to deem rooftops unsuitable for DPV hosting if there is no local electricity demand (e.g., if a building is abandoned). However, for developing countries seeking to use DPV systems to boost electrification levels, the presence of electricity demand may not be a relevant or appropriate DPV-hosting suitability criterion.

Other practical factors, such as the structural suitability of the rooftop to host DPV systems or the age of the building (which may be indicative of the need to update wiring infrastructure to host DPV systems), are not typically in technical potential estimates unless highly detailed sets are available.

Technical Potential: Calculate Number of DPV Panels

As a final step, each DPV system undergoes some form of technical performance modeling to create estimates of annual energy generation. In its most detailed form, this step includes the individual modeling of every DPV system on every suitable roof area, including customized consideration of rooftop orientation, tilt, and shading, as well as location-appropriate solar insolation data. In practice, rooftops with similar technical characteristics are grouped together and modeled as a single system. Commonly available tools such as NREL’s System Advisor Model (SAM) can be used to perform these technical performance simulations.

Calculating annual DPV generation levels involves formulating a number of assumptions about each DPV system, including the technical efficiency of panels (including module power density, DC-to-AC ratio, inverter efficiency, etc.) and contributing factors to system losses (e.g., due to soiling, wiring, snow, and other sources of loss).

Economic Potential

DPV economic potential is defined as the subset of available DPV technical potential that could be considered economically viable given a static set of a market and economic conditions. What renders a potential DPV system “economically viable” to a retail customer is typically defined by whether or not a project has a positive NPV, but other metrics such as simple payback period or return on investment (ROI) may also be used.

At a high level, DPV economic potential estimates are formulated by examining the entire DPV technical potential, and sorting DPV systems based on their ability to meet the relevant economic viability constraint imposed by the analyst. This sorting exercise requires that Individual Project Technical or Techno-economic Analysis be conducted for each DPV system to understand its economic performance. In practice, an economic potential analysis exercise relies on the automated modeling of a large number of individual DPV systems, using tools such as NREL’s SAM. Each economic potential estimate assumes a static set of market and economic conditions, such as DPV pricing, relevant financing, discount and macroeconomic inflation rates, and other key inputs and assumptions detailed on the Individual Project Technical or Techno-economic Analysis page. Importantly, financially viable DPV projects identified in the economic potential exercise will exhibit a range of financial attractiveness. For example, some projects in the economic potential estimate may just barely have a positive NPV, whereas others have significantly more attractive economic performance. In any case, all financially viable projects are aggregated into economic potential estimates.

Market Potential

DPV market potential estimates are defined as the subset of DPV economic potential that might feasibly be deployed under a static set of market and economic conditions, considering factors such as DPV project economics, consumer preferences, and past and present rates of DPV adoption. Put another way, it is the total amount of DPV deployment that would ultimately be adopted by customers in the long term, under the assumption that market and economic conditions remain the same.

Using Consumer Survey Data

Forecasts of technology adoption—including for DPV—often rely on characterizations of consumers’ “willingness to pay” (WTP) for the technology, and consumer surveys are the typical research tool for informing these characterizations. An example survey question probing WTP might be, “Would you be willing to adopt DPV if the payback period of your investment was 4 years?” Such questions could be posed across a range of payback period values to a mix of customers with distinct social, economic, and geographic characteristics.

Most consumer surveys focus on characterizing the “stated preferences” of customers, i.e., interpreting a customer’s response to survey questions at face value. Other, more complex survey methods probe this stated preference data to uncover the “revealed preferences” of customers, accounting for the gap between what consumers say they may be willing to do in a survey and their ultimate decisions to adopt or not adopt DPV (Dong & Sigrid 2018). Revealed preferences can also be identified with historic sales data, i.e., the actual consumer behavior to purchase a technology.

While DPV economics (e.g., simple payback period) tend to be the primary drivers of DPV adoption, research suggests economics alone is not a consistently robust predictor of adoption. Social science literature indicates other important effects can influence DPV adoption, including those highlighted in the table below.

| Effect |

Description |

|---|---|

| Peer Effects | The geographical presence of nearby customers or social influence of acquaintances adopting DPV can impact the attitudes and behaviors of prospective DPV customers |

| Environmental Preferences | The desire to adopt DPV may be influenced by the views and desires of customers to make environmentally conscious decisions. |

| Innovator Status | The desire to adopt DPV may be influenced by a customer's broader preference for and willingness to buy novel technologies, apart from the financial benefits. |

| Perceived Social Support | The perception that family and peers may be supportive (or unsupportive) of a decision to adopt DPV can influence decision making |

At a high level, consumer survey data is analyzed and used to formulate maximum market penetration curves (see next subsection).

Maximum Market Penetration Curves

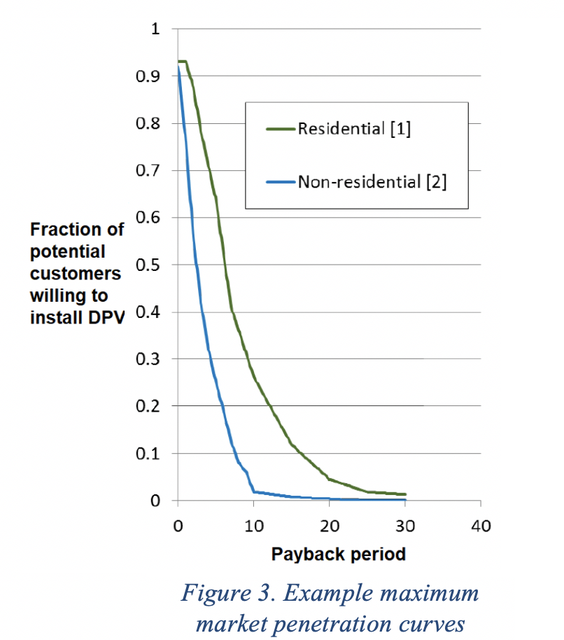

Maximum market penetration curves are used to formulate market potential estimates for a static set of market and economic conditions. They are designed to estimate the percentage of customers who will ultimately adopt a technology, as a percentage of the total customers who are technically eligible for adoption. More precisely, these curves mathematically characterize the relationship between DPV’s economic attractiveness (typically using simple payback period in units of years) and the maximum fraction of customers who would ultimately be willing to adopt DPV. These curves are formulated for different types of customers (e.g., residential vs. commercial) and reflect an assumption that system economics is the primary driver of DPV adoption, while also capturing noneconomic considerations of prospective customers.

Figure 3 shows illustrative shapes of maximum market penetration curves for residential and nonresidential customers. For a given payback period (X-axis), the fraction of potential customers who would be willing to adopt DPV (Y-axis) is depicted graphically. In practice, these curves are formulated and used for a single market and are also assumed to be constant over time; as DPV payback periods ultimately decrease over time as DPV prices fall, maximum market penetrations—and thus, the DPV market potential—would be expected to increase.

Market Deployment Estimate

Ultimately, the ability to formulate market potential estimates based on the economic attractiveness of DPV (i.e., the use of maximum market penetration curves) enables market deployment estimates to be formed. While market potential estimates describe the total amount of DPV that is likely to be adopted in the long run (i.e., a 20- to 30-year time frame),DPV market deployment estimates detail the trajectory of expected DPV deployment over time, often providing annualized or biennial estimates for 5- to 30-year periods.This is chiefly accomplished through the use of market diffusion curves.

Market Diffusion Curves

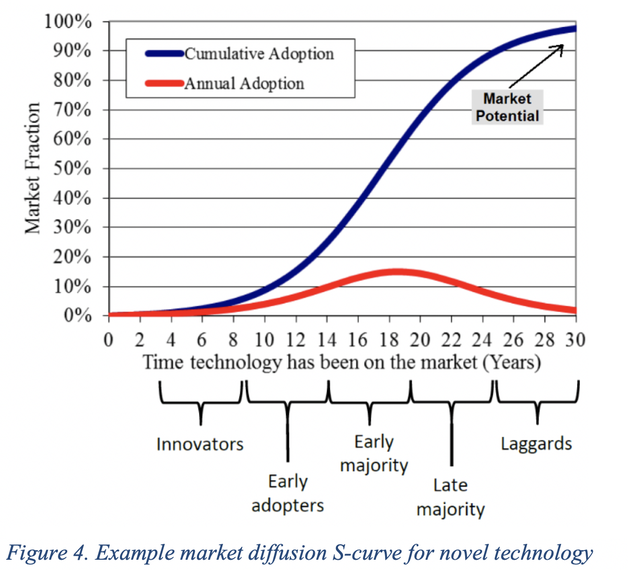

The most important mathematical methodology underpinning the formulation of DPV market deployment estimates is the market diffusion curve. Following the “diffusion of innovation” frameworks popularized by Bass (1969) and Rogers (2003), market diffusion curves are a commonly used approach to characterize how novel technologies are adopted in a marketplace over time. They suggest that technology adoption takes place in the shape of an “S-curve,” where the rate of diffusion is initially quite slow but accelerates as additional customers consider the new technology. Figure 4 presents an illustrative example of a market diffusion S-curve.

Market diffusion curves have various parameters that can be tuned to provide an S-curve shape that is appropriate for the market in question. The simplest specification includes two parameters, known as the coefficient of innovation (or P) and the coefficient of imitation (or Q). These parameters indicate the extent to which adoption of the new technology is driven by the number of prior adoptions. Are consumers adopting DPV because their neighbors are doing so? Or because of other external factors? Shaping market diffusion curves effectively, particularly in newly established markets, often requires seeking appropriate benchmarks and analogous situations from more established markets.

In the context of DPV, market diffusion curves are used to describe the expected cumulative DPV deployment for a given market over time. Market potential estimates are directly derived from maximum market penetration curves and are used to set the maximum long-term cumulative adoption of DPV in a market diffusion curve. Importantly, all market diffusion curves are “static,” meaning they apply for a fixed set of market and economic conditions. In other words, DPV deployment trajectories assume all factors that influence the economics of DPV, including DPV pricing, financing, and compensation mechanisms, remain the same over the length of the projection.

Static Market Deployment Estimates

Static market deployment estimates offer insights into the expected aggregate deployment of DPV for a static set of market and economic conditions. Figure 5 illustrates the process for formulating a static market deployment estimate.

Static market deployment estimates can be a useful indicator of expected DPV deployment, as they account for consumer preferences and behavior, past DPV adoption levels, and a simplified treatment of DPV economics.In practice, they are simpler to conduct than dynamic market deployment estimates (see next section). In markets experiencing declines in DPV pricing, static methodologies estimates may prove to be conservative, as the market potential (and thus the steepness of the market diffusion curve) may increase.

Dynamic Market Deployment Estimates

Dynamic market deployment estimates provide insights into the expected aggregate deployment of DPV over time, while accounting for changing market and economic conditions. Dynamic estimation methodologies recalculate DPV payback periods on a recurring basis (e.g., annually over a 30-year forecast period), using input assumptions about how market and economic conditions will change over time, to update the shape of market diffusion curves (and therefore the rate of diffusion) for each year in the forecast period. A single iteration of a dynamic market deployment estimate requires the formulation of a market diffusion curve for beginning in Period N. While this curve would extend through the end of the forecast period, it would only be used to forecast deployment for Period N+1. The cumulative deployment for Period N+1, along with any expected changes in market potential, would then be used to create the updated market diffusion curve that begins in Period N+1. This process is depicted in Figure 6 below.

Importantly, the primary driver of changes to the shape of market diffusion curves over time is the market potential estimate, which sets the maximum DPV deployment level (i.e., Y-value) that the curve can reach.Curve coefficients such as P and Q also influence the shape of the curve but tend to remain constant for a given market over time.

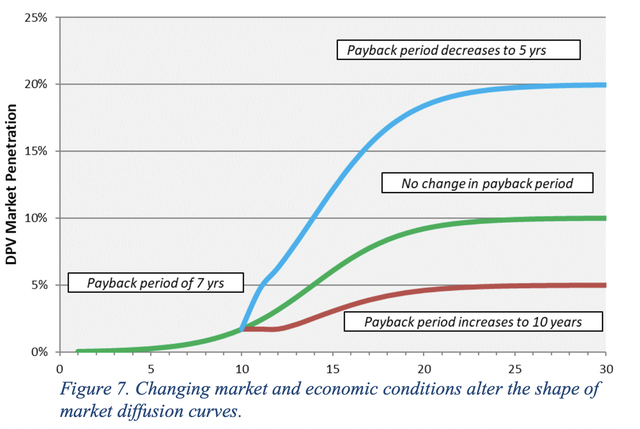

Figure 7 below provides an example of how changing market and economic conditions can alter the shape of a market diffusion curve. In this example, a green market diffusion curve illustrates expected DPV deployment for a market where the DPV payback period is 7 years, which corresponds to a maximum market potential of 10% of the total economic potential. Two additional curves illustrate how a change in payback period, after DPV has been deployed in the market for 10 years, would alter the trajectory of future DPV deployment. The blue market diffusion curve assumes DPV economics improve, with the payback period decreasing to 5 years and the market potential increasing to 20%. The red market diffusion curve assumes DPV economics worsen, with the payback period increasing to 10 years, resulting in a market potential decrease to 5%.

Analysis Applications and Linkages

Energy ministries and regulatory agencies can use DPV deployment analysis to understand how prospective changes to regulation or public policy may impact DPV deployment in their market. Distribution utilities can create market deployment forecasts to inform distribution network investment planning exercises. Market analysts and investors may conduct these analyses to understand investment opportunities and the growth potential of the market.

Dynamic DPV deployment estimates can potentially be linked with DPV Tariff Impact Analyses. In this case, DPV deployment levels for a given time period are used as an input assumption to a tariff impact analysis to set the assumed deployment level. Tariff impacts for that deployment level and time period are calculated and used to inform market and economic condition inputs for the subsequent time period of the dynamic DPV deployment estimate. In essence, one analysis passes its outputs back to the other analysis as an input, and this process moves forward in time iteratively over the forecast period.

Example Analysis Questions

Below is an inexhaustive list of illustrative analysis questions for market deployment estimates.

- What is the expected deployment of DPV in the next 5 years, assuming all market and economic conditions remain the same?

- What is the expected deployment of DPV in the next 10 years, assuming DPV prices decrease by 4% per year and the current net energy metering policy is maintained?

- What is the expected percent reduction in cumulative DPV deployment by 2030 if new customers are shifted from net energy metering with no annual net excess generation credit to net billing with a $0.04/kWh grid injection sell rate beginning in 2022?

- What is the expected change in DPV deployment by 2026 if all new DPV customers are placed on a declining block time-of-use retail electricity rate in 2021?

Discussion and Practical Considerations

Who can conduct this analysis? How costly and time-intensive is it to conduct?

Creating DPV deployment estimates is typically time- and resource-intensive process. More than likely, a small team of analysts may be required. Formulating technical and economic potential estimates likely requires advanced programming skills to manage large data sets and automate GIS analyses of suitable roof space and DPV techno-economic analyses. If new maximum market penetration curves are required, analysts will require some background in behavioral economics and experience in building and analyzing consumer surveys.

At the time of this writing, there are no existing commercial or open-source “plug-and-play” tools to create DPV deployment estimates, and thus a customized set of tools is currently a requirement. That being said, several existing tools and methods can be used to estimate the solar energy potential of a single home or building, which can be employed to formulate technical potential estimates. Depending on the availability of technical and economic potential data and the experience of the analyst(s), DPV deployment estimates can take 2–4 months of full-time work to complete.

What are the key challenges associated with getting these analyses right?

Shaping market diffusion curves robustly, particularly in newly established markets without significant data on deployment, can be a particularly challenging undertaking. Analysts may need to seek data from a “benchmark” market (i.e., an analogous market situation) to tune their diffusion curve coefficients. For example, an established DPV market (with robust data sets already available) that, in its earlier years, exhibited a similar per capita DPV growth rate as the jurisdiction being analyzed may be an appropriate benchmark. Other indicators, such as electricity prices, the readiness of the supply chain to provide DPV hardware, or the presence of similar regulations or policies (e.g., net energy metering), may also be used to seek a benchmark. One common approach is to examine historical data on the diffusion of energy efficiency measures (e.g., high-efficiency lightbulbs) in the jurisdiction in question—if good data exists, it can potentially be used to help shape market diffusion curves for DPV.

How can results be discussed effectively?

DPV market deployment estimates are often requested for, and intended to be used as, forecasts or predictions. With high-quality historical and current data, shorter-term forecasts can certainly be created in a robust manner. However, for longer time frames (i.e., 10–30 years), the methodology discussed on this page can be best understood as an effective framework to assess the relative impact of different technology, market, and policy conditions on DPV deployment. Thus, rather than asking, “What will cumulative DPV deployment be 20 years from now?” these tools are best used to ask, “What is the relative change in cumulative DPV deployment that might be expected 20 years from now if a particular policy changes?

Example Analyses

For further information, please contact Alexandra Aznar ([email protected]).